Dhi Artspace Founded in 2014 in the heart of Hyderabad city, Dhi Artspace is a gallery of note, with a printmaking facility, a library, and a history of exhibitions and displays of great significance in Hyderabad’s art dialogue. Moreover, Dhi Artspace is the sum of an idea and a dream born within the workings of the mind of its founder and director, Bhargavi Gundala. The idea is to find ways to seamlessly embroider and tie emerging creators into the fabric of art, merging them with the thread and fibre sewn by tenured and experienced art professionals. Together, as this tapestry grows, so does the legacy of art itself. This idea is expressed through Dhi Artspace’s relentless dedication to the promotion, support, and display of important, necessary, future-ready artworks and their artists to audiences across the nation. The dream - the vision - is communion. Dhi is a space where young artists, experienced mentors, art collectors, visitors, enthusiasts, historians, academics, all those minds that recognise the significance and vitality of art, may come together to turn their personal narrative into anthology, and their monologue into conversation. In support of this, Dhi Artspace has expanded into sister-verticals, including Dhi Contemporary, Dhi Collective, Dhi Residency and FACE.

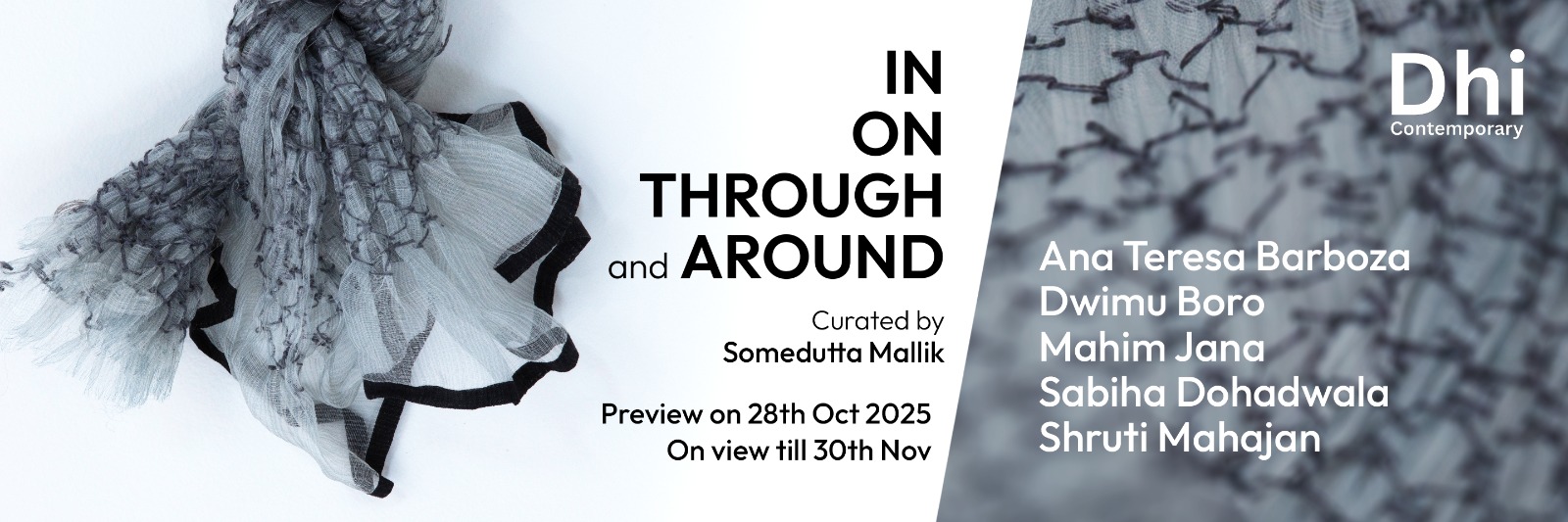

Dhi Contemporary a new initiative of Dhi Artspace, Hyderabad, aims to be a one-stop destination for young and emerging artistic talents in India. At its core, Dhi Contemporary wants to create a new generation of collectors, and art enthusiasts in Hyderabad by bringing them in sync with the shifting practices of contemporary art globally. Envisioned by artist, art collector, and gallerist Bhargavi Gundala, Dhi Contemporary sets out to expand the critical dialogues Dhi Artspace has been fostering since 2014. Through a fresh set of curated exhibitions, performances, film screenings, site-specific commissions, and more, Dhi Contemporary will lead the city into a new chapter pledging to build its visual art scene at par with the other art centers of the country.

Dhi Collectiveis a sister-vertical of Dhi Artspace, built to foster a new cultural ecosystem in the city of Hyderabad using the monument of the past and marrying it with the message of the future. Through talks, performances and theatre, conversations and workshops and the development of an artist guild, Dhi Collective endeavors to build a city bright and vibrant with cultural production, art appreciation and art-making. It is only when individual voices come together, in differing tenor and timbre, that an orchestra is born - and through orchestra, music comes to life.

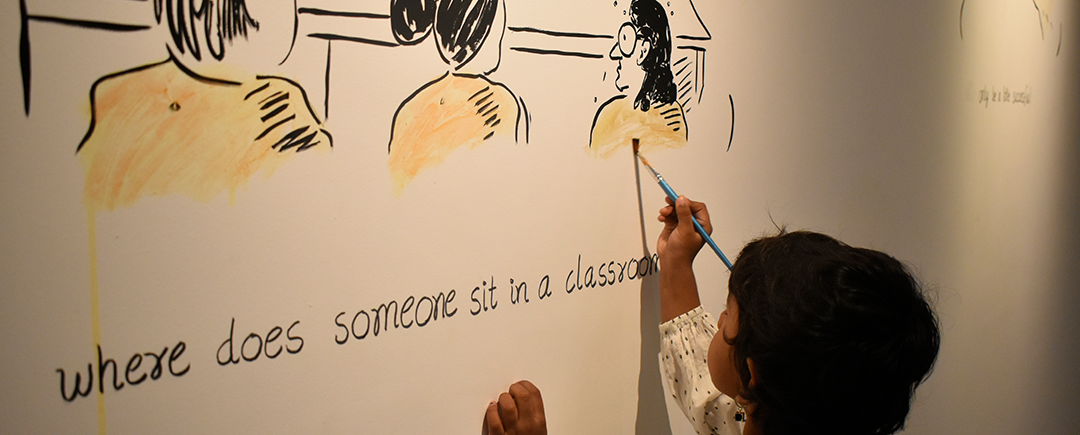

Dhi Residency A Creative Haven for Emerging Artists

Since 2014, Dhi Artspace has nurtured emerging talent and fostered contemporary art discourse. Dhi was thrilled to announce its Residency program in Hyderabad, a vibrant cultural hub. This is a residency that offers artists a unique opportunity to explore the city's rich heritage and diversity.

The residency program includes: Mentorship from senior art practitioners, studio visits and interactive sessions, city exploration and cultural immersion, open studio and interactive presentation and honorarium for selected artists.

Dhi is thrilled to host residencies that empower artists, providing a nurturing environment for them to grow and evolve as they shape the future of the art world.